ev tax credit 2022 cap

The new credits if Biden and Democrats finalize a deal would jump to 12500 maximum. Which is usually great.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Senate passes measure for 40000 cap on the EV tax credit and only EVs priced under 40000 would be eligible for 7500 credit under this plan.

. The renewal of an EV tax credit for Tesla provides new opportunities for growth. But if you dont have a tax liability theres nothing to apply this EV tax credit to. Then from October 2019 to March 2020 the credit drops to 1875.

January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. Lastly on August 10 the Senate passed a non-binding vote on a resolution to limit the tax credit to an MSRP of 40000 and single taxpayer income of 100000. The exceptions are Tesla and General Motors whose tax credits have been phased out.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. Get a rebate of up to 3000 with the purchase of a new electric vehicle. So if you buy your car in May 2022 you wont be using the tax credit until you file your 2022 taxes in early 2023.

California is lowering its MSRP limit and income cap for EV subsidies which offers 2000 USD for EVs and 1500 for plugin hybrids according to Green Car Reports. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. Based on our recent estimates and forecast Toyota will be the next manufacturer to reach the 200000 tax credit phaseout threshold likely in Q1 of 2022.

To qualify automakers must build the EV in the US with union labor for an extra 4500 over the current. The tax credits do not carry over to the following year so if you receive a 7500 credit on your new 2022 Leaf but only owe 5000 itll. There is a cap on this tax credit of 200000 electrified.

Also if youre self-employed and pay tax in instalments consider making smaller instalments if you plan on buying an EV later in the year. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018. Earlier this week the Senate voted to place price and household-income caps on the federal EV tax credit as part of the 35 trillion.

A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent. The 2022 Tax Credit Phaseout for Toyotas EV and Plug-in Hybrids is Coming Soon As Toyota reaches its market cap of 200000 Prius Primes and RAV4 Primes being sold the 2022 EV Tax credit will. Both new and used electric vehicles are eligible with MSRPs up to 60000 and 55000 respectively depending on the type of vehicle.

If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Californias MSRP limit on trucks and SUVs will remain at 60000. If you pay say 30000 in taxes are owed a refund of 2000 and then try to claim a 7500 tax credit youll only get the 2000 refund whereas if say you paid just 20000 in tax instalments and owed 1000 you could claim the.

From 2020 you wont be able to claim tax credits on a Tesla. There is a federal tax credit of up to 7500 available for most electric cars in 2022. This vote was just a political and non-binding resolution created so that some senators would have a public record that they dont want EV tax credits going to the wealthy.

US Senate puts 40000 cap on price of electric cars that qualify for EV tax credit ahead of reform. Several months later it seems that revisions to the credit are returning to lawmaker agendas. The Nova Scotia Electrify program works very similarly to the federal iZEV Incentive Program.

Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit. The US Senate has voted to approve a non-binding resolution setting a 40000 threshold on the. What Is the New Federal EV Tax Credit for 2022.

Here are the currently available eligible vehicles. Opens website in a new tab. This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate.

The state has lowered its max MSRP limit for eligible EVs to 45000 from 60000 for passenger cars. From April 2019 qualifying vehicles are only worth 3750 in tax credits. Updated April 2022.

President Bidens EV tax credit builds on top of the existing federal EV incentive. It is possible to create a liability of. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned.

421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible. The joint-filer cap will be decrease from 300000 to 200000. The cap for head-of-household filers will drop from 204000 to 175000.

Ford is most likely to quickly follow Toyota and reach 200000 sales of EVs in Q3 2022 followed by Nissan but not until at least Q2 or Q3 of 2023. Senate votes to place a 40000 price cap on EV tax credit.

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

How To Calculate The Federal Tax Credit For Electric Cars Greencars

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Toyota S Statement On The Need For Equal Application Of The Electric Vehicle Tax Incentive Toyota Usa Newsroom

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Toyota S Ev Tax Credit Cap Is Expected To Be Reached Soon Bloomberg

Toyota Buyers Soon Will Lose U S Electric Vehicle Tax Credits Los Angeles Times

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

The Canada Us Electric Vehicle Market Navigating The Road Ahead

Nissan Ariya And Leaf Will Coexist Two Evs Well Under 40 000 Thanks To Ev Tax Credit

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

How To Calculate The Federal Tax Credit For Electric Cars Greencars

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

.jpg)

Latest On Tesla Ev Tax Credit March 2022

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Latest On Tesla Ev Tax Credit March 2022

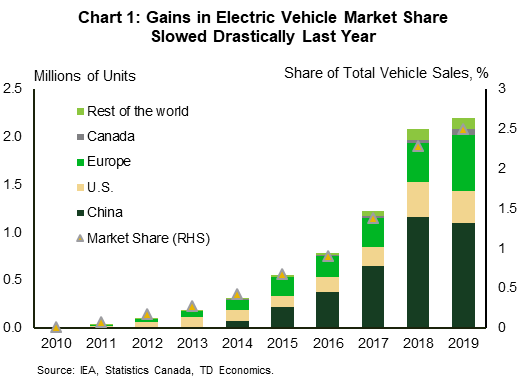

Inside Clean Energy Us Electric Vehicle Sales Soared In First Quarter While Overall Auto Sales Slid Inside Climate News