unfiled tax returns 10 years

Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. Start with a Simple and Easy Free Consultation.

Unfiled Tax Returns Mendoza Company Inc

The penalty for not filing at all is x10 larger than the penalty for filing and then not paying.

. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. State tax returns not filed for more than 20 years.

Havent Filed Taxes in 2 Years. Additionally failing to pay tax could also be a crime. Produce critical tax reporting requirements faster and more accurately.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. Delinquent Return Refund Hold program DRRH. Havent Filed Taxes in 3 Years.

The act of not filing ones tax returns is a crime. If you fail to file your tax returns you may face IRS penalties and interest from the date your taxes were. Find Out Today You Qualify.

A taxpayer who has unfiled tax returns is called a nonfiler. 0 Federal 1799 State. The minimum penalty is the smaller of the tax due or 135.

Any information statements Forms W-2 1099 that you may. Systemically holds an individual taxpayers income tax refund when their account has at least one unfiled tax return within the five years. If you fail to file your taxes youll be assessed a failure to file penalty.

Ad Use our tax forgiveness calculator to estimate potential relief available. Missed the IRS Tax Return Filing Deadline. This is because the tax law changes from year to year and some of the.

Get free competing quotes from the best. This penalty applies the first day you are late and it can get up to 25 of the. Ad Dont Face the IRS Alone.

We evaluate all of your options which. The IRS has some conflicting information when it comes to several years of unfiled tax returns. Ad Quickly Prepare and File Your Prior Year Tax Return.

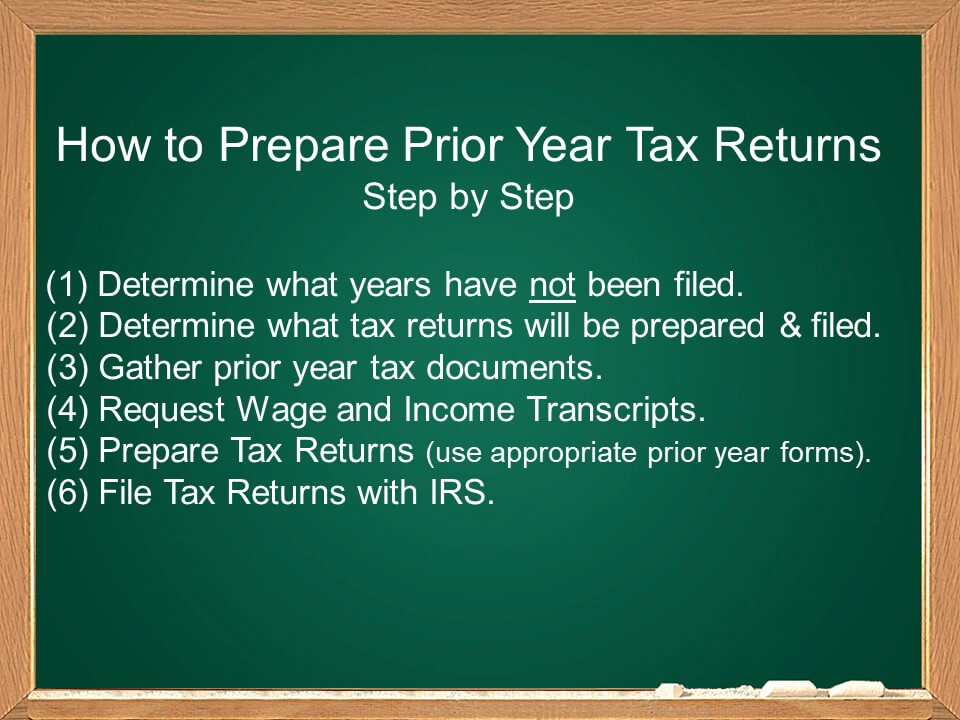

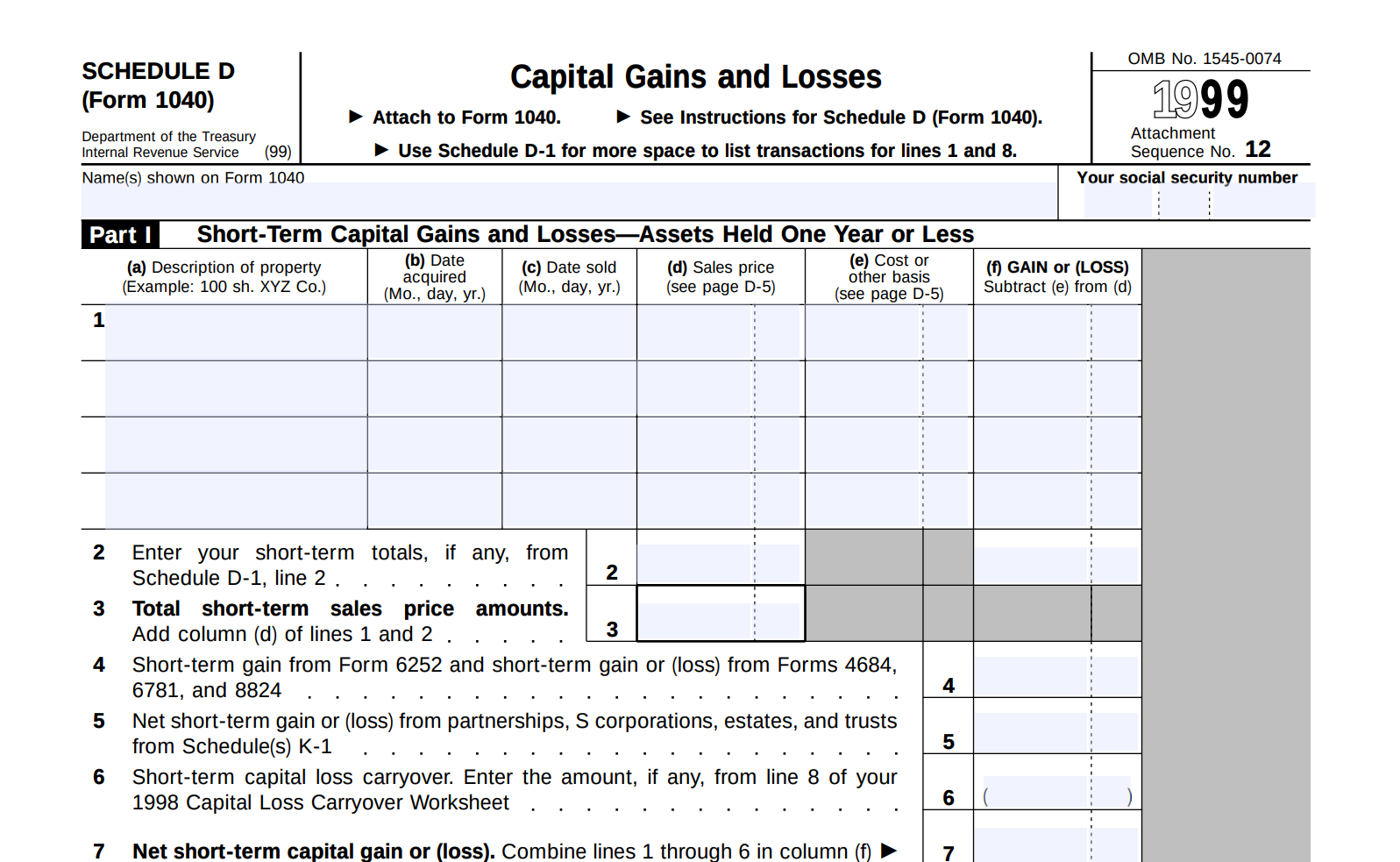

If you owe tax the IRS will impose a failure-to-file penalty for 5 of the tax owed per month that you are late. So your unfiled 2017 tax return originally due 041518 can be filed. Prepare the Returns You cannot file an older year return using the current year tax forms and instructions.

Havent Filed Taxes in 5 Years. Ad Get Back Taxes Help in 3 Steps. Part of the reason the IRS requires.

Ad Dont Face the IRS Alone. Ad Do You Need To Set Up A New Jersey State Tax Installment Plan. Sort out your unpaid tax issues with an expert.

Get Back In Good Standing. IRS and states will usually come up with much higher balances than you. Havent Filed Taxes in 10.

After that the debt is wiped clean from its books and the IRS writes it off. Get a Free Quote for Unpaid Tax Problems. Under the Internal Revenue Code.

You can possibly face imprisonment for a length of time proportional to each year of. The late fining penalty for a C-Corporation is 5 of the outstanding tax for up to five months. Ad Get Back Taxes Help in 3 Steps.

Generally speaking under IRC 6502 the IRS. However in practice the IRS rarely goes past. So always file even if you cant pay -- the penalty is larger that way.

Get a demo today. After the expiration of the three-year period the refund. The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118.

Unfiled Taxes Last Year. Ad Honest Fast Help - A BBB Rated. Ad Learn More about How Annuities Work from Fidelity.

What is the best way to file your missing back taxes. In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have. Often they go back many years longer than the IRS.

Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. A copy of your notices especially the most recent notices on the unfiled tax years. Start with a Simple and Easy Free Consultation.

There is no statute of limitations on a late filed return. After May 17th you will lose the 2018 refund as the statute of limitations. An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances.

Bring these six items to your appointment. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. The Statute of Limitations Only Applies to Certain People.

This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

Unfiled Tax Return Penalties Can Be Very Expensive Make This Your First Step Hellmuth Johnson

Unfiled Tax Returns Tax Champions Tax Negotiation Services

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

How Far Back Can The Irs Collect Unfiled Taxes

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

The Facts You Need To Know About Unfiled Taxes And Paying Penalties

Irs Temporarily Halts These 10 Scary Taxpayer Letters

The Consequences Of Not Filing Taxes

Irs Letter 5972c You Have Unfiled Tax Returns And Or An Unpaid Balance H R Block

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

How Far Back Can The Irs Go For Unfiled Taxes

Premium Psd Conference Flyer Flyer Psd Conference

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Irs Tax Returns Best Tax Relief Company Is

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829