free cash flow yield screener

See the Big Picture With the Only Tool That Visualizes the Flow. What is free cash flow and free cash flow yield Before we go any further lets make sure we know what we are talking about.

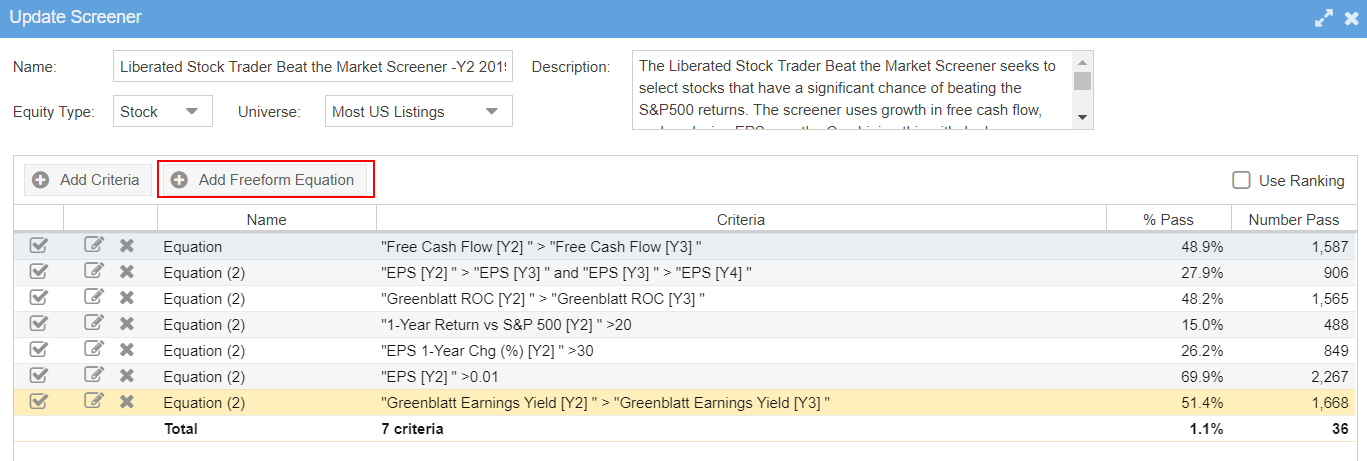

4 Steps To Build The Best Munger Buffett Stock Screener

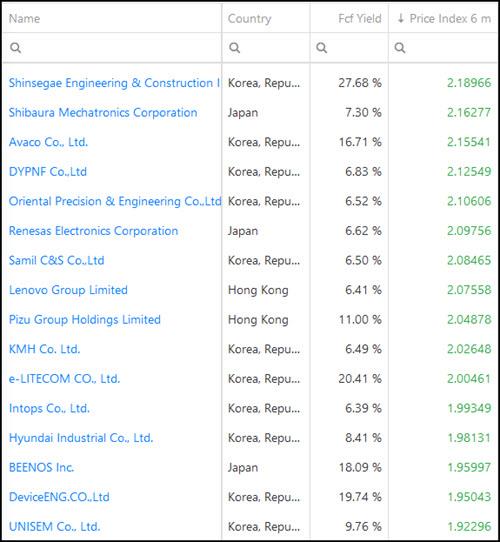

5 rows Free Cash Flow Yield.

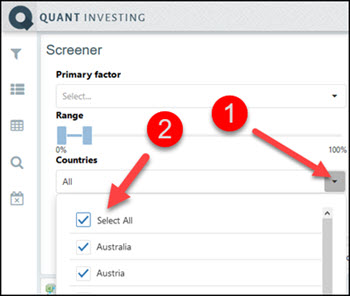

. Free cash flow yield is really just the companys free cash flow divided by its market value. Excel-based Investment Research Solution for Serious. In the Quant Investing stock screener we define Free Cash Flow FCF as.

Every week we scan. Free Cash Flow Yield 16932 Billion 21516 Billion Free Cash Flow Yield 786. Ad 3 Ways to Create a Cash Flow Surge in Your Business.

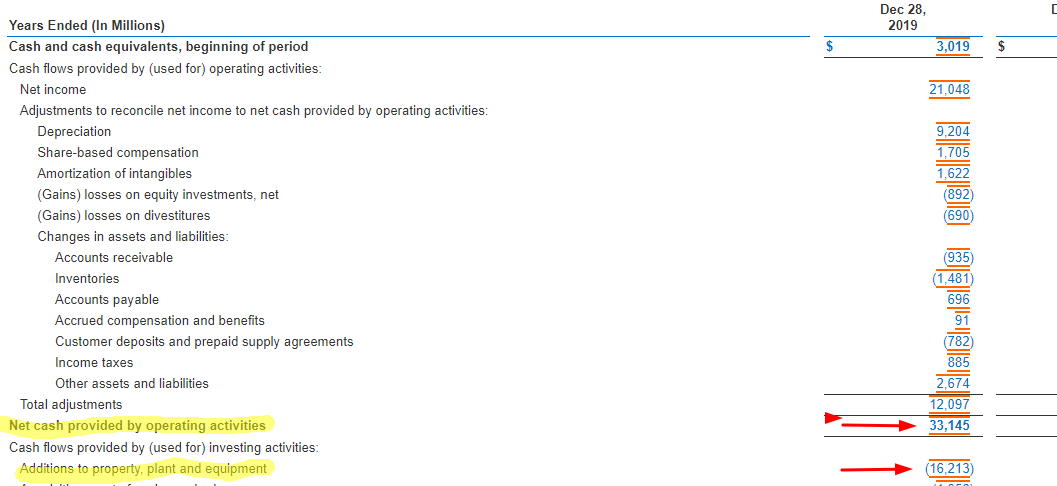

- a free list of stocks with strong cash flow yield. Total Cash from operations from the companys Cash Flow Statement Minus Capital Expenditure also from the Investing section of the Cash Flow Statement. A stock screener that allows you to screen stocks based on Old School Value fundamentals valuation action score and thousands of other metrics.

We applied the discounted cash flow and discounted earnings to the high Predictability Rank and calculated the intrinsic values of the these companiesThese are the companies that appeared to be undervalued as measured by discounted free cash flow model or discounted earnings model. Then the free cash flow value is divided by the companys value or market cap. Get 3 cash flow strategies to stop leaking overpaying and wasting your money.

You can use the FCF Score with Free cash flow yield when looking for stable high dividend yield companies. Good fcf yield and growth. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

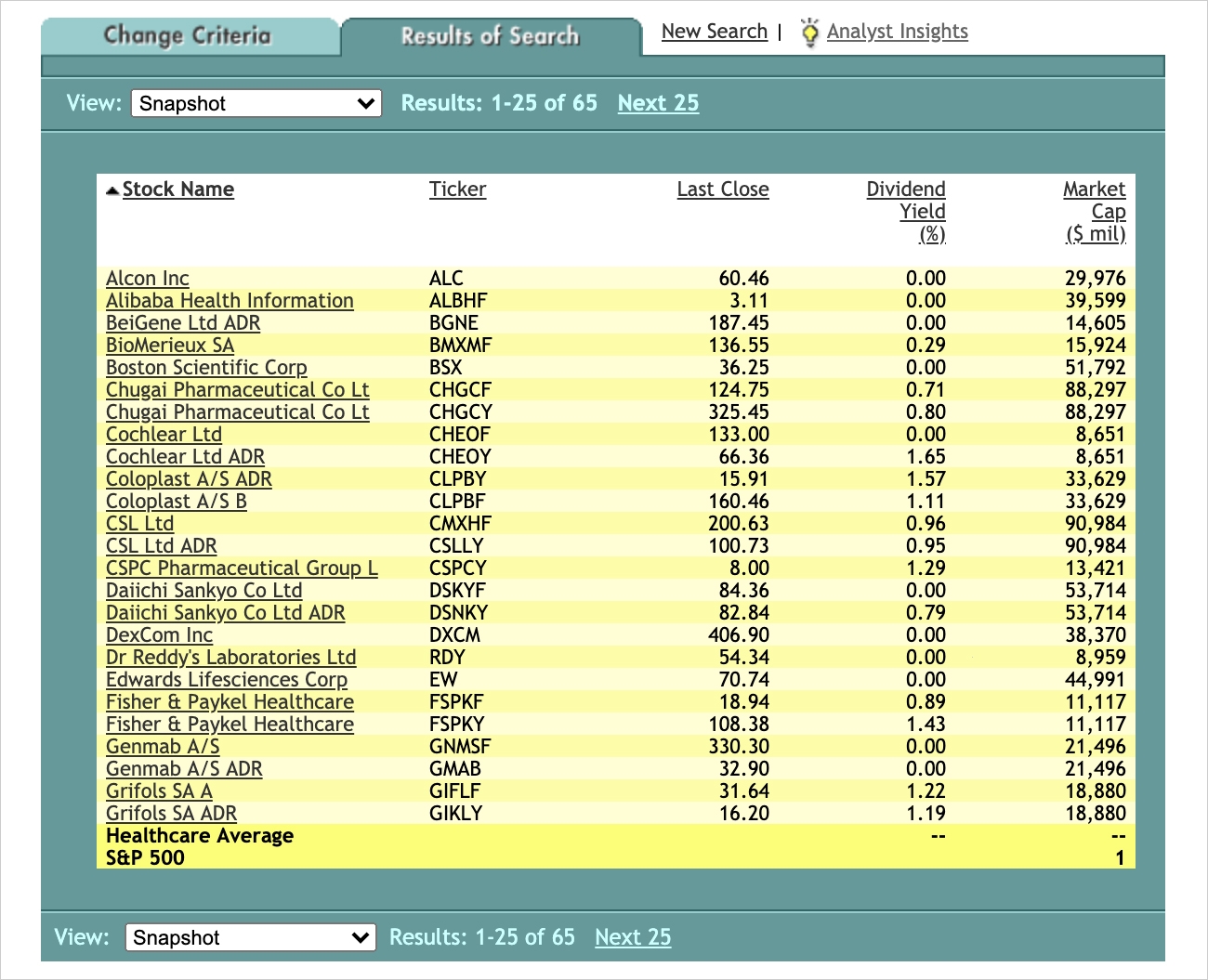

21 rows Free Cash Flow Yield Get updates by Email Companies with Free cash flow yield more. We could also look at the free cash flow yield in relation to its trailing-twelve-month numbers or TTM to get the latest yield. The Pacer Cash Cows Index Series uses a free cash flow yield screen to invest in 100 companies from various indexes.

SP500 -18 DOW -13 FTSE 100 00 NIKKEI -17 OIL 11 GOLD 04. You can also use our formulaic calculation engine to compute your own free cash flow metric using the Operating Cash Flow and Capital Expenditures variables. Price Free Cash Flow Ratio Stock Screener with an ability to backtest Price Free Cash Flow Ratio Stock Screening Strategy and setup trade alerts for Price Free Cash Flow Ratio signals.

Get the tools used by smart 2 investors. Watchlists Ideas Screener Data Explorer Charts Saved Work. Our service Screenerco Stock Screener offers built in variables for Free Cash Flow EVFCF Price to Free Cash Flow Per Share and other variables that incorporate free cash flow.

To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations. There is no guarantee dividends will be paid. The FCF Score is thus put together of 70 Free cash Flow Growth and 30 Free Cash Flow Quality The higher the value the better as it means free cash flow growth is high or the variability of free cash flow is low or both.

A companys ability to pay dividends may stop or be limited in the future. Now to calculate the free cash flow yield we divide the free cash flow by the market cap of the company. The ratio is calculated by taking the.

Free Cash Flow Yield between 10 and 20. Free cash flow is the cash that a company is able to generate after paying off all of the bills maintaining existing asset bases and pursuing future growth. Backtest your Price Free Cash Flow Ratio trading strategy before going live.

Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio. Investors who wish to employ the best fundamental. News Fundamental Chart Financials and Stock.

301 rows Cash Flow Kings. The formula and methodology are described in What worked in the market from 1998-2008. Get updates by Email.

Ad Our Strong Buys Double the SP. FCF is what enhances shareholder value and how dividends can be consistently paid. Trade Faster With Algorithmic Trade Ideas And Powerful Visuals.

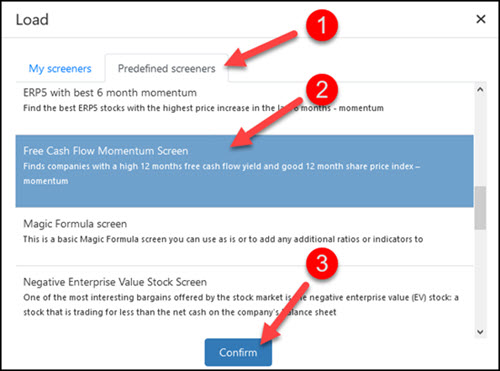

Premade Screener Stocks With High Free Cash Flow Yield. Use it if you are a dividend yield investor. Ad Tired of Raw Data.

Based On Fundamental Analysis. With that said it is clear that a company able to increase and generate FCF will appreciate in value as. These ETFs aim to provide a continuous stream of income andor capital appreciation over time.

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Equity Valuation From A Bond Perspective 5 Picks With Attractive Fcf Yields Seeking Alpha

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Is There A Stock Screener That Can Calculate Free Cash Flow Of Listed Stocks Quora

What Is Free Cash Flow And How To Analyse Free Cash Flow For Fundamental Analysis

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Is There A Stock Screener That Can Calculate Free Cash Flow Of Listed Stocks Quora

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Best Stock Screeners Finviz Blog

Basic Stock Screener Morningstar

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

My Top 5 Favourite Things About Stock Rover Stock Rover

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Fast Free Cash Flow Yield Screener For S Amp P 500 Stocks Using Marketxls Template Included

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Is There A Stock Screener That Can Calculate Free Cash Flow Of Listed Stocks Quora